Email Us:

Call Us:

866-754-6379

Email Us:

Call Us:

866-754-6379

What is Long Term Care Insurance?

Long-term care insurance is designed to cover the costs associated with extended care that isn't typically covered by regular health insurance.

Depending on the policy, it can include coverage for:

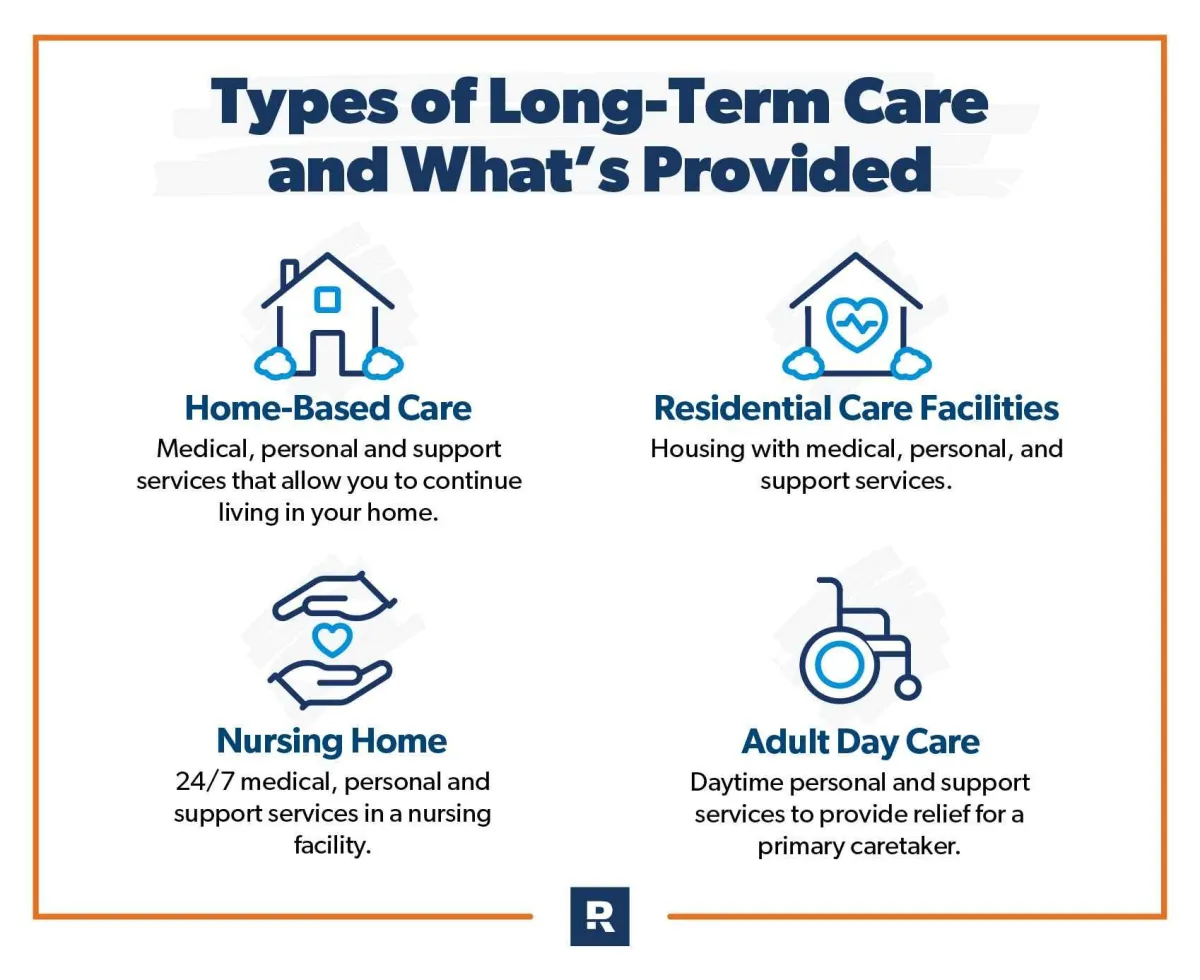

Facility Care: This includes care in places like nursing homes, Residential Care Facilities, Residential Care Facilities for the Elderly (also known as Assisted Living Facilities).

Home Care: Coverage can extend to services like Home Health Care, Personal Care, Homemaker Services, Adult Day Care, Hospice Services, and Respite Care.

In California, there are three types of long-term care insurance policies available:

Nursing Facility and Residential Care Facility Only: These policies cover skilled, intermediate, or custodial care in nursing homes or similar facilities, as well as assisted living care in Residential Care Facilities.

Home Care Only: These policies cover services provided in the home, such as Home Health Care, Adult Day Care, Personal Care, Homemaker Services, Hospice Services, and Respite Care.

Comprehensive Long-Term Care: These policies offer the most extensive coverage, including care in nursing facilities, assisted living in Residential Care Facilities/Residential Care Facilities for the Elderly, and home and community care.

Long-Term Care Insurance

Why working with a broker is better!

Products with Your Total Financial

Wellness In Mind

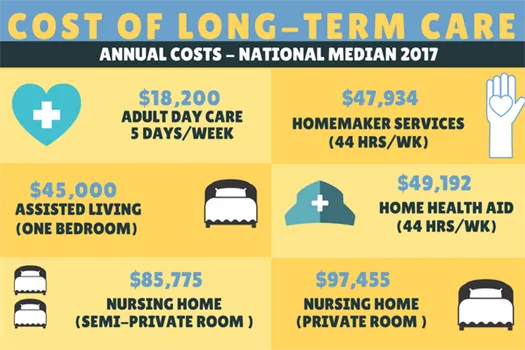

Long-term care involves various services designed to meet an individual's health or personal care needs over a period of time. The services help people live as safely and independently as possible when they cannot handle daily activities alone.

People need long-term care when they have a chronic health condition or disability. The need can arise suddenly, such as after a stroke, or it can develop more slowly, such as someone becoming frail due to a worsening disability or disorder.

What care services are typically covered by LTC insurance?

Get Care in your own home

Adult Day Care

Assisted Living

Nursing Home Care

Skilled Nursing

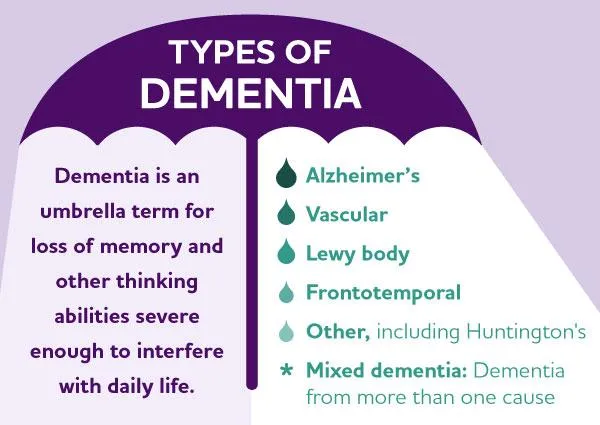

Alzheimer's and Dementia Care

Hospice Care

Pays off your mortgage in the event of death, disability, or critical illness. It ensures your family can stay in your home without financial strain, providing a targeted benefit that decreases with your mortgage balance, offering peace of mind and security

They provide guaranteed minimum returns linked to a stock market index, combining growth potential with stability. This ensures steady income and peace of mind for retirees.

These annuities can offer growth, but it's important to know what you're buying.

Term Life Insurance provides affordable coverage for a set period, paying a death benefit if the policyholder passes away during the term. It's a cost-effective way to protect loved ones and secure financial stability.

Covers funeral and burial costs, offering a simple and affordable way to ease financial burdens on loved ones. It ensures that end-of-life expenses are covered, providing peace of mind and financial protection.

Insurance that provides income protection if you're unable to work due to illness or injury. It replaces a portion of your income, helping you maintain financial stability and cover essential expenses during recovery.

Offers financial support if you're diagnosed with a severe illness, such as cancer or heart disease. It provides a lump-sum payment to cover medical expenses and living costs, easing the financial burden during a challenging time.

Ensures a stable income during retirement by safeguarding your savings from market volatility and unexpected expenses. It helps maintain financial security and provides peace of mind, allowing you to enjoy your retirement without financial worries.

Provides early financial protection for children, offering benefits like savings for future education and coverage for unexpected health issues. It’s designed to give families peace of mind and secure a financial foundation for their child's future.

Promotes strategies focus on eliminating debt and building financial security. By managing and reducing debt, you can achieve financial freedom, enhance your savings, and create a more stable and stress-free financial future.

Todd Gorman

CA License # 0C72954

National Producer # 3146641

4883-B Ronson CT, San Diego, CA 92111

(844) 619-9500

G2 | Agency ©2025

Not affiliated with the U. S. government or federal Medicare program.

We do not offer every plan available in your area. Any information we

provide is limited to those plans we do offer in your area.

Please contact

to get information on all of your options. ( TTY 1-877-486-2048 )

Jane Doe

Satisfied Customer

Jane Doe

Satisfied Customer

Jane Doe

Satisfied Customer

Jane Doe

Satisfied Customer